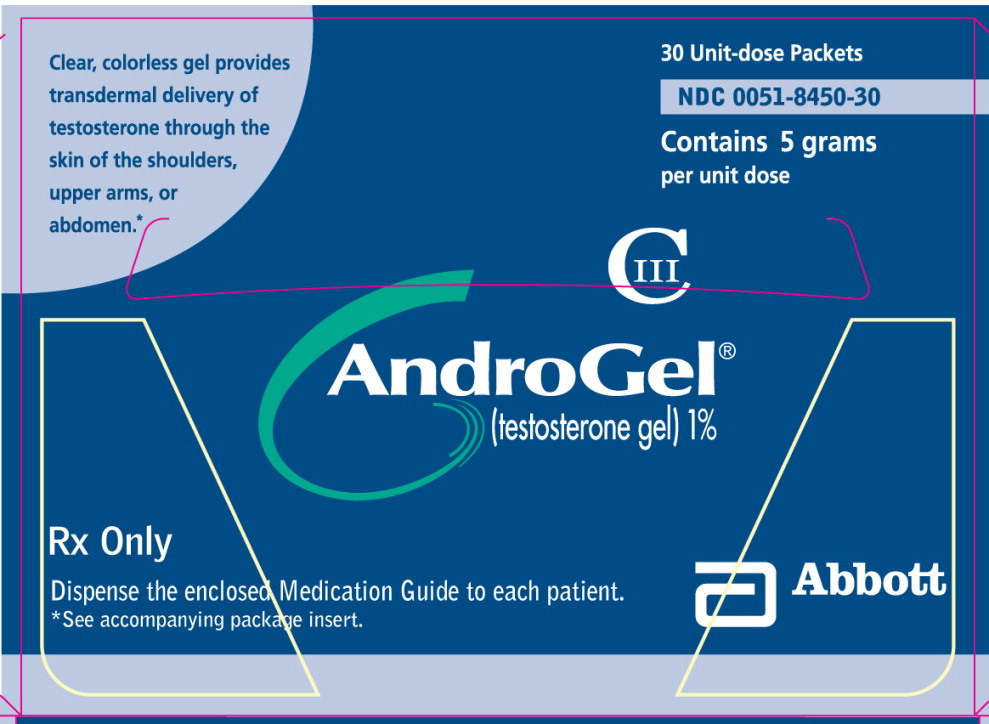

The pharmaceutical giant Solvay Pharmaceuticals is unapologetic about its actions aimed at maintaining its monopoly on the phamaceutical testosterone gel Androgel (an anabolic-androgenic steroid). Solvay has “bought off” generic companies who planned to introduce inexpensive, generic versions of Androgel. The generic companies Watson Pharmaceuticals, Par Pharmaceutical, and Paddock Laboratories were prepared to offer a cheap generic testosterone gel as early as 2006 after the FDA granted Watson final approval for its generic product in January 2006. Solvay paid the generic companies a substantial amount of money to delay their entry into the generic Androgel marketplace until 2015.

The threat of generic competition would have decimated Solvay’s sales of Androgel; AndroGel has been their top-selling product with sales exceeding $300 million in 2006 and $400 million in 2007. Generic competition to Solvay’s flagship product Androgel could reduce the price of testosterone gel as much as 90% when compared to brand name Androgel. The payments to delay entry into the generic marketplace aka “pay-for-delay” settlements would be highly profitable for Solvay by extending brand name patent protection for several years. The windfall profits would come at the expense of consumers and federal taxpayers costing them billions of dollars (“Concurring Statement of Commissioner Jon Leibowitz Federal Trade Commission v. Watson Pharmaceuticals et. al.,” February 2).

Denied the possibility of the dramatic savings brought by generic competition — which can drive prices down to as little as ten percent of the brand price — American consumers, especially the elderly and the uninsured, are the victims here. So is the federal government, which pays nearly one-third of the nation’s prescription drug costs overall and will have to pay dramatically higher prices for AndroGel.

Eliminating these pay-for-delay settlements is one of the most important objectives for antitrust enforcement in America today. The reason why is simple: illegally delaying generic entry on even a single drug can cost consumers billions of dollars. And our annual reports on patent settlements suggest a very worrisome trend: nearly half of all brand-generic patent settlements — 28 out of 61 in fiscal years 2006-2007– include some type of payment to the generic and the generic’s agreement to stay out of the market. Generic entry prior to patent expiration, which had been a common occurrence until the past few years, is at risk of becoming the rare exception.

Testosterone is not a new drug. It was first artificially synthesized in 1935 and have been commercially marketed in the United States since the 1950s; pharmaceutical gel products have been available for decades. Solvay was able to substantially mark up the price of Androgel to consumers when the FDA approved Solvay’s New Drug Application for testosterone replacement therapy in hypogonadal men in February 2000.

The monopolistic practices by Solvay and its co-defendants represent a blatant attempt to maintain a monopoly on sales of the testosterone formulation Androgel.

The mind-boggling number of “convenient barriers” that serve to maintain big pharma’s monopoly on anabolic steroids by preventing generic entry in the United States represents a series of amazing coincidences.

-

The pressure on compounding pharmacies specializing in anabolic-androgenic steroid products that are generic and non-brand alternatives to big pharma brands. Compounding pharmacies focusing on steroids have been prosecuted e.g. Signature Pharmacy and Applied Pharmacy Services.

-

The discontinuation of relatively inexpensive generic Deca Durabolin (nandrolone decanoate) by Watson Pharmaceuticals. Watson’s nandrolone decanoate cost consumers $192 per month. It may be re-introduced but only after the FDA approves a rumored Organon new drug application for HIV-related wasting allowing big pharma to mark up prices dramatically due to patent protection.

-

The discontinuation of the very inexpensive generic, compounded nandrolone decanoate by Applied Pharmacy Services. APS’ nandrolone decanoate cost consumers $48 per month.

-

The promotion of the very expensive brand name Oxandrin (oxandrolone) as an alternative to cheap Deca Durabolin as a treatment for wasting. Savient Pharmaceuticals brand name Oxandrin costs consumers $1200 per month.

-

The prosecution of doctors who prescribe anabolic steroids produced by compounding pharmacies.

-

The new definition of counterfeit drugs that reclassifies practically all generic anabolic steroids as “illegal countefeits” if they are not manufactured by a pharmaceutical multi-national corporations.

-

Increased criminal penalties for advertising and/or importing cheap generic anabolic steroids.

Extended patent protection by preventing access to low-cost, generic anabolic steroids results in billions of dollars in additional profit annually for Big Pharma and their shareholders. This enormous windfall comes at the expense of the consumer.

Big Pharma is incredibly fotunate to have so many fortuitous events support their monopoly on U.S. sales of anabolic steroids!

Hopefully, the Federal Trade Commission under a President Barrack Obama administration will live up to Obama’s campaign promise of ensuring “that the law effectively prevents anticompetitive agreements that artificially retard the entry of generic pharmaceuticals onto the market…”

About the author

Millard writes about anabolic steroids and performance enhancing drugs and their use and impact in sport and society. He discusses the medical and non-medical uses of anabolic-androgenic steroids while advocating a harm reduction approach to steroid education.

Leave a Reply

You must be logged in to post a comment.