Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

Guest viewing limit reached

- You have reached the maximum number of guest views allowed

- Please register below to remove this limitation

- Already a member? Click here to login

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trump Timeline ... Trumpocalypse

- Thread starter CdnGuy

- Start date

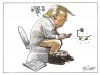

1) Based on today's Twitter meltdown, I think we may have underestimated the narcissistic injury the widespread mocking of Trump's disinfectant comments. This was not criticism -- it was mocking. That's intolerable.

2) Also, the petulance about working hard -- we shoudl remember that despite the fact he's barely working, THIS IS THE HARDEST HE'S WORKED IN YEARS. Not to mention --

3) I mean, his total business for a decade at least has been being on TV, paying for sex, and being a compliant money laundering cog. Sending the kids off to negotiate with the Russians or Iranians (look it up). That's it.

4) But now -- No dopamine hits. No Mar-a-Lago, so no rich guys who validate his own status as Very Important Man, praising him, no rallies -- just his Washington lackeys and let's face it, like porn, he's used to them and needs new stimulus constantly.

5) To step from a world where for ten years, probably more, you never heard a single disagreement or criticism you had to take seriously or couldn't pay to go away, to a job that comes with endless responsibilities even when you shove 80% of them off.

6) Trump is, frankly, in hell. But he's too much of a narcissist to step away and let the rest of us fix what he broke. So we all get to ride the breakdown together. And live with 40% of the country wrapped in a full on cult cognitive dissonance meltdown.

Thread by @jonrog1: 1) Based on today's Twitter meltdown, I think we may have underestimated the narcissistic injury the widespread mocking of Trump's disinfect…

2) Also, the petulance about working hard -- we shoudl remember that despite the fact he's barely working, THIS IS THE HARDEST HE'S WORKED IN YEARS. Not to mention --

3) I mean, his total business for a decade at least has been being on TV, paying for sex, and being a compliant money laundering cog. Sending the kids off to negotiate with the Russians or Iranians (look it up). That's it.

4) But now -- No dopamine hits. No Mar-a-Lago, so no rich guys who validate his own status as Very Important Man, praising him, no rallies -- just his Washington lackeys and let's face it, like porn, he's used to them and needs new stimulus constantly.

5) To step from a world where for ten years, probably more, you never heard a single disagreement or criticism you had to take seriously or couldn't pay to go away, to a job that comes with endless responsibilities even when you shove 80% of them off.

6) Trump is, frankly, in hell. But he's too much of a narcissist to step away and let the rest of us fix what he broke. So we all get to ride the breakdown together. And live with 40% of the country wrapped in a full on cult cognitive dissonance meltdown.

Thread by @jonrog1: 1) Based on today's Twitter meltdown, I think we may have underestimated the narcissistic injury the widespread mocking of Trump's disinfect…

Senorman

Member

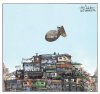

More corporate welfare for big businesses under Paycheck Protection Program:

Intellinetics, a software company in Ohio, got $838,700 from the government program — and then agreed, the following week, to spend at least $300,000 to purchase a rival firm.

///

Legacy Housing, a Texas company that manufactures premade homes, announced on April 1 that it had access to a new $25 million credit line. Curtis D. Hodgson, Legacy’s executive chairman, told investors that he expected any damage from the coronavirus to be short-lived. “Our order book is still strong, and we are well-positioned once the situation begins to normalize,” he said.

Less than two weeks later, on April 10, the company announced that a local lender, Peoples Bank, had approved it for $6.5 million under the S.B.A. loan program.

///

Escalade Sports, which makes things like table tennis tables and basketball hoops, already had a $50 million credit line from JPMorgan Chase. The company’s chief executive, Dave Fetherman, told investors this month that the company, based in Evansville, Ind., had “a strong balance sheet” and was seeing rising demand for its products, with so many Americans cooped up in their homes.

Days earlier, Escalade got a $5.6 million federally backed loan. A spokesman for Escalade said the company “fully met all required conditions at the time we applied for the P.P.P. loan.”

///

MiMedx Group, a biopharmaceutical company in Marietta, Ga., got a $10 million loan on April 21. On April 6, the company had agreed to pay the Justice Department $6.5 million to resolve allegations that it violated federal law by knowingly overcharging the Department of Veterans Affairs for medical supplies.

///

Infinite Group, a cybersecurity firm in Pittsford, N.Y., had been borrowing hundreds of thousands of dollars from its board members and the brother of a top executive at annual interest rates as high as 7.5 percent. This month, Infinite secured a nearly $1 million federally backed loan whose 1 percent interest rate could allow the company to dramatically lower its funding costs. Company officials didn’t respond to requests for comment.

///

And Manning & Napier, an investment firm in Fairport, N.Y., that has about $20 billion in assets under management, disclosed in March that its chief executive, Marc O. Mayer, earned nearly $5 million last year. On April 19, the company was approved for $6.7 million in the paycheck protection loans — even as the company said it would pay out a quarterly dividend to its shareholders.

Source: Large, Troubled Companies Got Bailout Money in Small-Business Loan Program

I’ve been applying for these loans on behalf of small businesses. Most have gone through from our local bank, but US Bank said they are too back logged to accept an application for a measly $12,500 from a single member LLC. What a joke.

Similar threads

- Replies

- 186

- Views

- 4K

- Replies

- 35

- Views

- 612

- Replies

- 21

- Views

- 1K