In the past several years, the national movement to end drug prohibition has accelerated. Nine states and Washington, DC, have legalized recreational marijuana, with at least three more states (Connecticut, Michigan, and Ohio) likely to vote on legalization by the end of 2018. Dozens of others have decriminalized the substance or permitted it for medicinal use. Moreover, amid the nation’s ongoing opioid crisis, some advocates and politicians are calling to decriminalize drugs more broadly and rethink our approach to drug enforcement.

Drug legalization affects various social outcomes. In the debate over marijuana legalization, academics and the media tend to focus on how legalization affects public health and criminal justice outcomes. But policymakers and scholars should also consider the fiscal effects of drug liberalization. Legalization can reduce government spending, which saves resources for other uses, and it generates tax revenue that transfers income from drug producers and consumers to public coffers.

Drawing on the most recent available data, this bulletin estimates the fiscal windfall that would be achieved through drug legalization. All told, drug legalization could generate up to $106.7 billion in annual budgetary gains for federal, state, and local governments. Those gains would come from two primary sources: decreases in drug enforcement spending and increases in tax revenue. This bulletin estimates that state and local governments spend $29 billion on drug prohibition annually, while the federal government spends an additional $18 billion. Meanwhile, full drug legalization would yield $19 billion in state and local tax revenue and $39 billion in federal tax revenue.

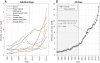

In addition, this bulletin briefly examines the budgetary effects of state marijuana legalizations that have already taken place in Colorado, Oregon, and Washington. This study finds that, so far, legalization in those states has generated more tax revenue than previously forecast but generated essentially no reductions in criminal justice expenditure. The bulletin offers possible explanations for those findings.